Reinsurers who provide richer supply curves are more likely to achieve their target lines

Tremor Technologies, Inc., the leading online reinsurance pricing and placing platform, reports a strong correlation between the likelihood of a successful allocation and the number of points in a reinsurer’s supply curve suggesting that reinsurers who provide richer supply curves are more likely to hit their target. In effect, rich supply curves as part of the anonymized aggregate supply that the cedent sees are more likely to be realistic and influence the cedent’s final pricing, leading to a successful allocation for the reinsurer.

“Why is this important? Reinsurers are portfolio managers - they have different pricing strategies that vary with quantity, peril, region and more. Only Tremor offers reinsurers the opportunity to express their precise and complete strategy per placement in confidence - which allows us to deliver transparent, competitive market clearing prices for cedents every time”, said Sean Bourgeois, Tremor CEO.

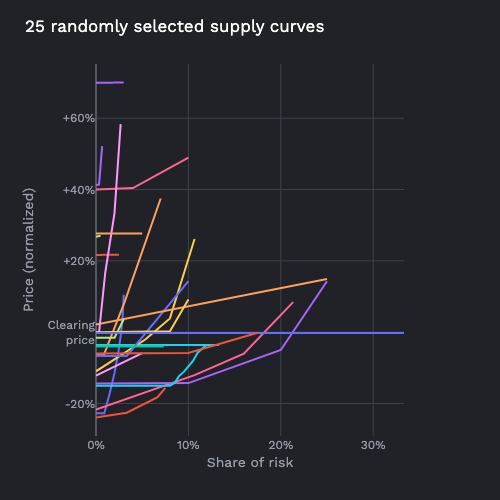

Each normalized supply curve below represents a reinsurer’s authorization for a specific placement: the y-axis is reinsurer’s price relative to the clearing price, the x-axis is the line size as a share of the risk. The curves effectively represent different strategies. Some are flat and connect two points, but the majority use sloping segments to indicate line sizes increase with price at different rates.

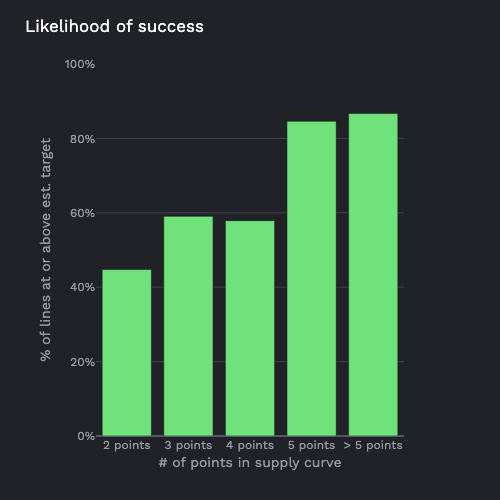

As for the whole population, the number of points in a supply curve is an important metric that captures the overall complexity of the reinsurer’s authorization. As the number of points increases, so too does the allocative precision that the reinsurer will get; reinsurers with more points in their supply curve tune their line based on the final price chosen by the cedent. The cart below breaks this down for real curves, more than 40% of Tremor supply curves include at least 4 points.

“Insurers and reinsurers have just experienced a historically challenging renewal season where the negotiation process was painful and extensive, nobody ended up with what they wanted and price discovery was almost non-existent. The common process this year of re-issuing FOTs and short placements said it all - the prices were wrong and there was no visibility to understand incremental cost in real time. Tremor offers the reinsurance market tools so that both sides can avoid this pain, delivering true market clearing prices with real time incremental cost analysis - this is all possible because we are able to capture reinsurer’s unique strategies and risk appetites in a way that only Tremor’s modern market tech and confidentiality rules can”, said Sean Bourgeois, Tremor CEO.

Cedents interested in learning more about Tremor’s technology and how we can help are invited to reach out directly to the company by contacting Suzan Jo at sjo@tremor.co.

Tremor

Tremor