Today’s hardening market is challenging for so many reasons. Reinsurers are suffering from catastrophe fatigue and Covid losses. They are projecting rate increases but their rate expectations are not uniform. Primary insurers may decide to retain more risk rather than pay higher prices for protection, despite the fact that this would increase capital constraints.

By far, the worst part about today’s hardening market is the uncertainty that comes from a lack of coordinated information. Reinsurers don’t want to underprice. Cedents don’t want to overpay. Everybody knows the market will meet somewhere in the middle, but they don’t know where. Capacity goes nowhere. The process can’t move forward.

When things are uncertain, conditions appear worse than the reality of the marketplace. Capital is available, but less certain. It can be more difficult to access.

Tremor’s unique technology and process move the placement forward

Transacting in a hardening market is like a buyer and seller engaged in a metaphorical staring contest. Noone wants to “blink” by relaxing their pricing first. The buyer wants to price at the status quo. The reinsurer wants to see a price increase.

This struggle occurs because external sources/reinsurers hold back key pricing information. Without a clear transaction deadline, reinsurers may wait weeks or months to offer their lowest price. Tremor’s process creates a fixed schedule and requires all quotes be submitted over the same time period. In essence, Tremor gets everyone to blink at the same time.

In a hardening market, Tremor employs a unique pre-auction discovery process that sets pricing parameters. That way, everyone knows approximately where the final price will land. Then a coordinated auction with a common finish line brings the pieces together to complete the placement efficiently and optimally.

Tremor’s process will still feel familiar. The cedent maintains complete control over their panel selections. They can manage maximum allocations per market, they can include a maximum budget and much more. Reinsurers have the option of specifying dependencies and subjectivities. All quotes remain sealed and confidential.

When all quotes are collected, Tremor’s platform contains a true picture of the entire marketplace. Tremor uses all of this data to calculate the optimal placement price (market clearing price) and optimal allocations. Everyone’s terms are satisfied simultaneously. There is never an oversubscription; therefore, the cedent never overpays. Uncertainty is replaced by confidence in an efficient marketplace. Plus, the process is fast. Pricing is determined within days.

One insurance executive remarked that before Tremor, he knew he was overpaying for protection but he did not have a way to figure out the fair price he should be paying. With Tremor, he always transacts at the market clearing price.

Noone can determine the optimal placement price without factoring in thousands of reinsurer prices and detailed allocation preferences along with the buyer’s requirements. These permutations, added together, amount to millions of possible outcomes. Yet today, most reinsurance buyers are not leveraging technology to price and allocate risk.

A small change, a big impact

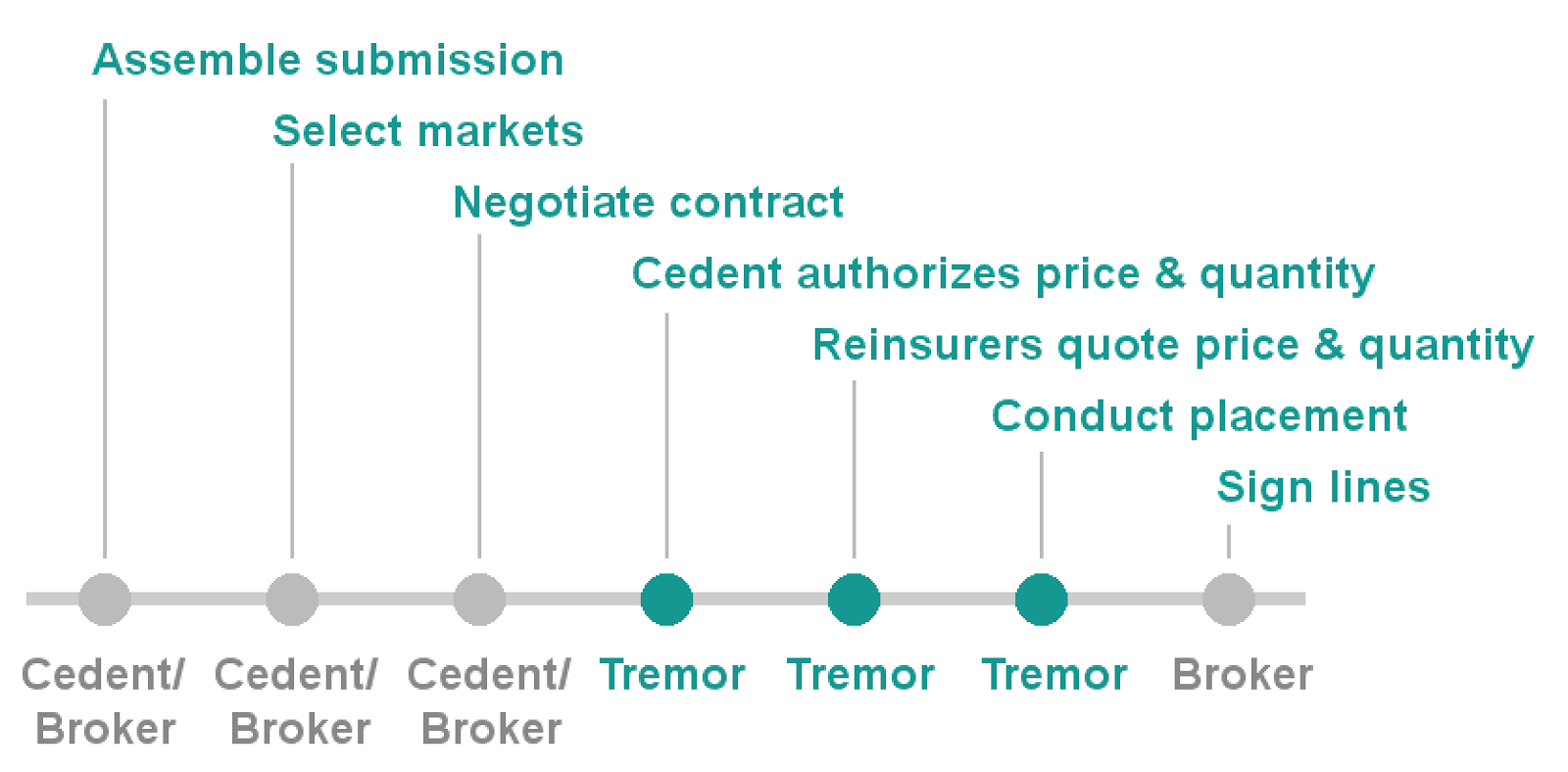

Tremor’s technology optimizes pricing and allocation, working together with the existing process. Cedents and their brokers still assemble submissions, select markets and negotiate contracts.

Tremor is working successfully with many insurers and their ceded reinsurance teams. Leading insurers working with Tremor include W. R. Berkley, Allianz, Markel, Nephila Capital and more.

Even in a hardening market, cedents can improve placement outcomes using Tremor’s technology. Competitive markets attract more reinsurers and more capital overall. Ultimately this creates a more efficient reinsurance market. Tremor has developed the only technology platform that can bring this kind of change to the reinsurance industry.

Achieve better reinsurance execution. Schedule a call with one of our reinsurance marketplace experts.

Tremor

Tremor