Market Summary

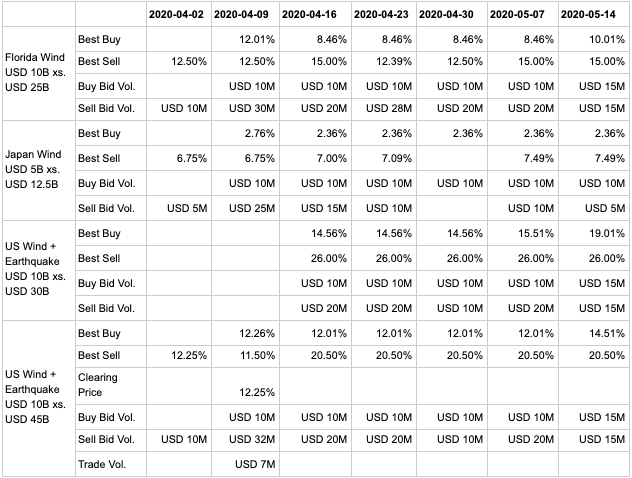

Tremor’s weekly ILW (industry loss warranty) market is growing. In its first six weeks, Tremor has seen an average of more than USD 60M capacity offered and USD 30M of protection requested. Spreads have fluctuated, with the best buy and sell prices converging to produce a successful transaction for US wind and earthquake risk. Spreads are narrowing, and activity is expected to increase going into June and July.

About the Marketplace

The ILW market today is a shadow of what it should be. ILWs are simple contracts that can be executed easily, yet are powerful enough to cede with minimal basis risk. With this combination of simplicity and power, it is easy to imagine a world where reinsurers use ILWs as the foundation for leveraging their underwriting expertise: reinsurers craft a proprietary book of business, then offload generic risk wholesale through ILWs.

Sadly, today’s ILWs are crippled by an inefficient market. Far from being the wholesale backbone of the reinsurance industry, the market today is thoroughly opaque – nobody knows the true price, and matching buyer and seller is largely a game of luck, with willing parties often passing as ships in the night. Without transparent pricing and without a reliable way to consummate a trade, it’s impossible for cedents to rely on ILWs and unsurprising that ILWs transfer a relatively small share of the market’s risk.

Tremor’s weekly marketplace brings revolutionary transparency and reliability to ILW trading. Tremor establishes a standard basket of ILWs that are traded on schedule and reveals rich information about aggregate supply and demand. This allows everyone to trade with confidence that the structures they need will be available at a fair market price.

The mechanics of each auction are simple. Tremor maintains a standard basket of ILWs that are posted each week periodically updating the trigger and risk offerings based on market interest. Interested parties submit blind, sealed bids to buy and/or sell the posted ILWs. Upon the close of bidding, Tremor computes a market clearing price for each ILW and reports consequent trades to the trading partners. Tremor also reports anonymized aggregate statistics to the market.

While its mechanics are simple, Tremor’s live marketplace represents an entirely new way to trade. In today’s opaque brokered market, information about interest is kept a closely guarded secret. On Tremor, transparent information drives the market – activity drives more activity, carefully concentrated in standard ILWs to maximize successful trade. Savvy buyers and sellers leverage this snowball effect, coming to the market to offer their terms early and often, then repeating and updating bids week over week as others enter the market and react.

Price and Volume History

Price and volume are summarized in the figures below for the four structures in Tremor’s current basket of ILWs:

- Florida Wind: USD 10B xs. USD 25B (PCS)

- Japan Wind: USD 5B xs. USD 12.5B (PCS)

- US Wind and Earthquake (excluding PR and T): Two triggers, USD 10B xs. USD30B and USD 10B xs. USD 45B (PCS)

(In week 3, corridors were added to existing ILWs around the original triggers, and a second trigger was added for US Wind and Earthquake risk.)

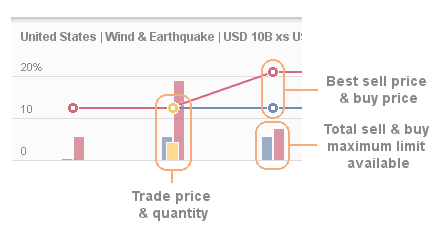

The following data points are reported for each auction and product:

- Buy and sell limit available – The total limit priced by buyers (respectively sellers) irrespective of price.

- Best buy and best sell prices (the price spread) – When buy bids (respectively sell bids) are present, the price (% rate on line) at which the first dollar of coverage would be bought (respectively sold).

- Trade volume – The total volume (dollars of limit) transacted.

- Clearing price – When coverage is transacted on an ILW, the price (% rate on line) of the transaction.

All prices are reported net of brokerage and fees.

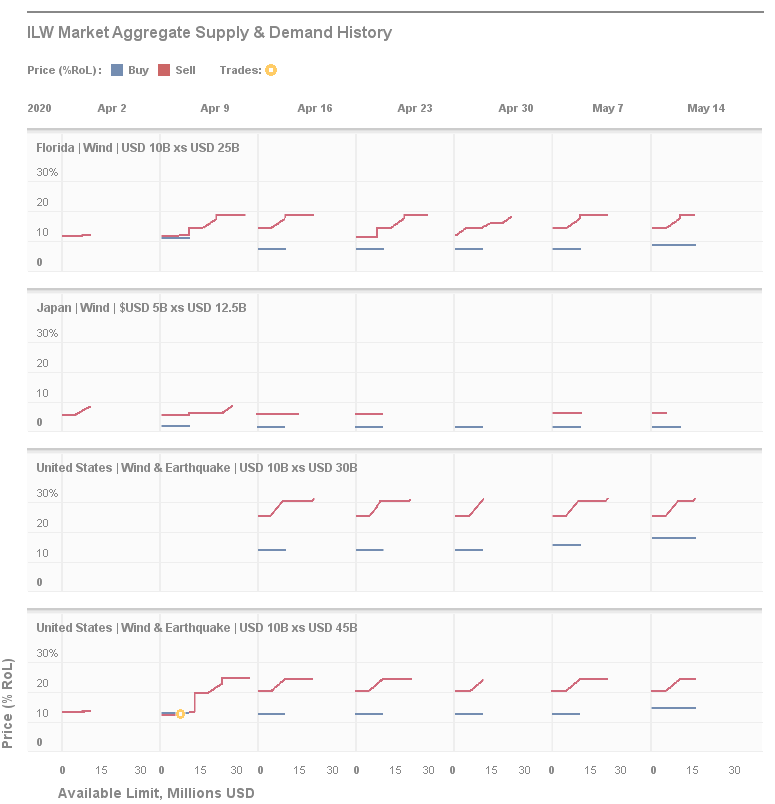

Aggregate Supply and Demand

The order book on Tremor is captured by aggregate supply and demand curves. An aggregate supply curve represents the total amount of coverage sellers bid to provide at each price point. Likewise, aggregate demand captures the total amount of coverage buyers bid to purchase. Example: the aggregate supply curve for the Florida Wind ILW on April 9 indicates that at 14% ROL, sellers would collectively supply USD 10M of coverage.

Aggregate supply and demand for the last six weeks are shown in the figure below.

Join the Market

For more information on how to participate in Tremor’s ILW marketplace or to learn more about Tremor, please contact Suzan Jo (sjo@tremor.co).

Tremor

Tremor