Your window to the market.

Faster

Price and place risk in days.

Better

See the market and precisely control what you buy or sell.

Competitive

A competitive marketplace drives best pricing and terms.

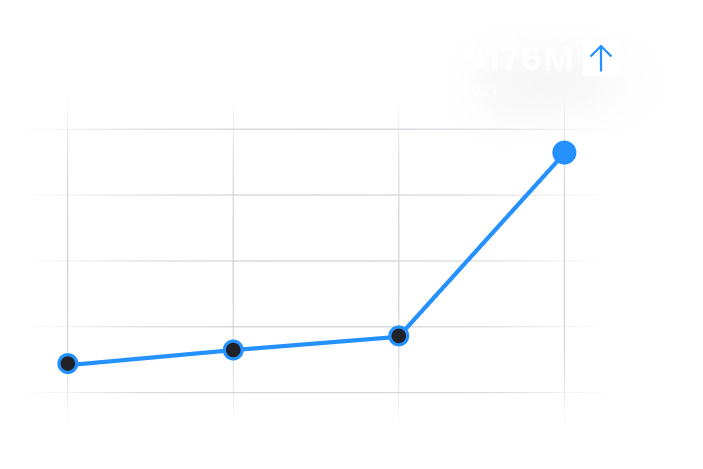

Premium placed

Tremor continues to post strong year-over-year growth, placing $176M of premium in 2021.

- $2B+ Limit placed

- $275M+ Total premium transacted

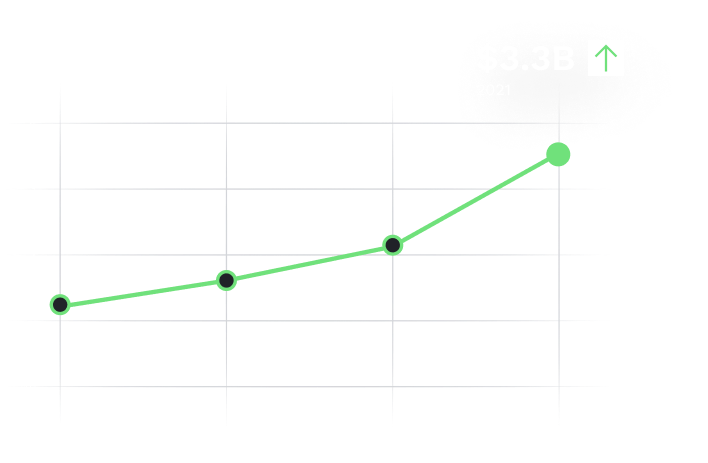

Capacity offered

Reinsurers continue to put more of their capacity on Tremor, surpassing $3.3B offered in 2021.

- $8B+ Limit offered to data

- 120+ Reinsurers signed up

News & Events

View all

News - Jun 2, 2023

Tremor Launches Wordings™ to Digitize Reinsurance Contract Negotiation

Tremor Technologies, Inc., the leading online reinsurance pricing and placing platform, has followed up its groundbreaking in-marketplace communications platform launch with a powerful solution to completely digitize the reinsurance contract negotiation and approval process with its release of Tremor Wordings™.

“A well known industry pain point, negotiating and finalizing contract wordings for traditional reinsurance placements involves dozens of versions of documents with out of synch track changes, roughly managed with spreadsheets exchanged between insurers, brokers and reinsurers.

News - May 23, 2023

AdvantageGo and Tremor Announce Strategic Alliance

AdvantageGo, a leading commercial insurance and reinsurance software provider, part of Coforge, today announced a strategic alliance with Tremor, a leading online reinsurance pricing and placing platform.

Modernising the way to place reinsurance, Tremor provides reinsurance cedents with a new channel and an automated approach for finding the best market rates for reinsurance protection.

The cost of reinsurance has increased dramatically at recent reinsurance renewals. Hard market pricing has put pressure on insurance carriers trying to renew their large reinsurance treaty programmes.

Blog - May 18, 2023

The value of brokers and market experts

Brokers are market experts. They live and breathe their markets and apply their unique expertise to help clients to get the best results. As modern technology revolutionizes the way humans connect – from social networks to programmatic trading – the need for their expertise navigating complex markets like reinsurance has never been greater.

The history of broking Broking has always been about connecting the right client and counterparty. Historically, the hardest part of making a deal was finding the people who wanted to trade.

Pushing the boundaries of an industry steeped in tradition.

Tremor has received accolades in a string of important industry competitions and publications.

Tremor

Tremor